Green hydrogen makes a headway

Noble Varghese

In 2022, the number of countries that formalised a green hydrogen policy to facilitate industry involvement and provide a roadmap for a hydrogen economy in their respective nations, went up to 26 from just 17 in the year 2021.

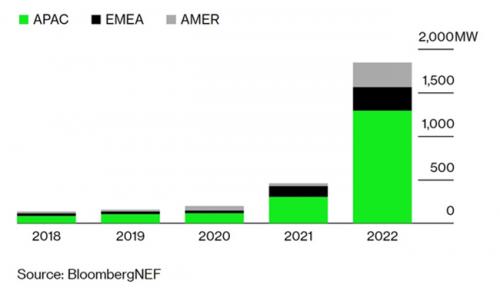

One of the key components of producing green hydrogen is the electrolyser – the machine used in electrolysis that, using electricity, breaks down water molecules into its core elements – hydrogen and oxygen. Global investment growth in green hydrogen can be tracked by the increase in production of electrolysers worldwide. Worldwide electrolyser sales doubled from 200 megawatts (MW) in 2020 to 458 in 2021, according to Bloomberg New Energy Finance (BNEF), a clean energy research group. They’re expected to triple in 2022, reaching anywhere from 1,800 MW to 2,500 MW, BNEF predicts. It may be the kind of growth spurt solar power experienced a decade ago.

Closer home, following Prime Minister Modi’s 2021 announcement of India’s green hydrogen push, and the launch of the National Hydrogen Mission that aims to produce 3 MMT of green hydrogen by 2025 and 21 MMT by 2050, some of India’s industry stalwarts have also thrown their hats into the ring. Reliance, for instance, announced earlier this year that they plan to invest approximately Rs 6 Lakh crore) for producing green hydrogen in the state of Gujarat.

Public sector companies like Indian Oil Corporation Ltd. (IOCL), GAIL, ONGC, BPCL, HPCL, OIL and NTPC have made similar plans for green hydrogen production in India from this year onwards. NHPC, in 2022, also awarded tenders for green hydrogen production and for acquiring fuel cell buses in Ladakh.

New Uses: The main uses of hydrogen currently are as a feedstock for the fertilizer industry, as a reducing agent in the steel industry or in oil refineries to reduce sulphur content of fuels.

In the steel industry, hydrogen could play the dual role----of providing heat as well as a reducing agent. Currently, hydrocarbons are preferred as they can easily play this dual role and reduce the oxides from various iron ores to form CO2 and raw iron. Understandably, the CO2 emissions from this process are high. But, if hydrogen replaces these hydrocarbons, the by-products would almost solely be water (H2O). According to a recent CSE report, replacing hydrocarbons with hydrogen has the potential to reduce emissions from the steel industry by up to 95%.

According to the IEA’s 2022 Global Hydrogen Review and BP’s 2022 Energy Outlook, the major new demand for hydrogen will come from the transport sector in the next 3 decades, with new industrial applications coming close behind.

Currently, transport, steel, fertilizer and cement industries together account for approximately 25% of global GHG emissions. Adapting these industries to continue manufacturing their products by using green hydrogen instead of fossil fuels can reduce a quarter of our global GHG emissions.

Although hydrogen fuel cell cars have not enjoyed the wild popularity amongst climate-conscious buyers as EVs have, they continue to hang on as a third alternative in the global passenger vehicle market. Only, three manufacturers – Honda, Toyota and Hyundai – currently have a fuel cell passenger car on the market. All three of their cars store hydrogen on board, can be fully refuelled in under 10min, and have a driving range upwards of 500 km on a full tank.

In February of 2022, India's Ministry of Road Transport and Highways (MoRTH) authorized the use of hydrogen as an automotive fuel in the country. The specifications for internal combustion engines provide for an 18% blend of hydrogen with compressed natural gas (CNG). And then in March, the Union Minister for MoRTH, Nitin Gadkari, launched the Toyota Mirai as a test vehicle to study if fuel cell vehicles can be a feasible alternative for Indian roads and climatic conditions.

The Indian railways too plans to launch hydrogen powered trains by 2023-24. In January 2021, they had invited bids to develop hydrogen fuel cell trains for their narrow-gauge sections in Himachal Pradesh. India currently has around 13,500 trains running every day, 5000 (37%) of which are diesel locomotives, the rest being fully electric. If the Indian Railways successfully manages to convert all these diesel trains to green hydrogen, then they have the potential to save more than 24 million tonnes of CO2 emissions every year and 2,400 million litres of diesel fuel (approx. 14,400 crore per year ) for India.

Green hydrogen is also being encouraged in India for energy security reasons. Currently, India’s coal, oil and gas import bill amounts to Rs 11 Lakh crore every year. Analysts say that the recent policy push for setting up hydrogen valleys in India will help reduce this import burden as well as provide energy security in a fast-changing global geo-political landscape.

However, India stands at a crucial cross-road before green hydrogen can replace its dependence on fossil fuels. “Unless electrolysers – critical for producing green hydrogen and contributing about 20% to the overall price – are indigenised quickly, we might miss the bus”, says Pashupathy Gopalan, Director of Ohmium, India’s largest electrolyser manufacturer. India needs to make sure it doesn’t repeat the mistake it made with solar years ago, and include policy changes that will quickly bring local electrolyser technology to scale, instead of depending on Chinese or European electrolyser imports. This will ensure energy security for India in case of any geo-political tensions affecting fossil fuel imports in the future.

Share this article